Hinge Health, Inc. (HNGE) is a digital-based Physical Therapy (PT) app service.

The company is disrupting the PT market by automating 95% of the PT process with its AI software. Consumers love it and so do enterprises, with 42% of the Fortune 500 adopting Hinge's offerings, which for now, has been mostly centered on MSK (Musculoskeletal) indications.

Hinge has a huge moat. The company has all Top 5 Healthcare systems and the Top3 PBMs as partners already locked up. While customer concentration is a clear risk, their top 3 healthcare systems are sealed through 2027, mitigating any near-term risk of customer loss.

Having noted such, considering Hinge has a 98% retention rate and its win-rate for new business in 2026 is accelerating markedly, investors can rest easy for now. Hinge will own this space for the next few years.

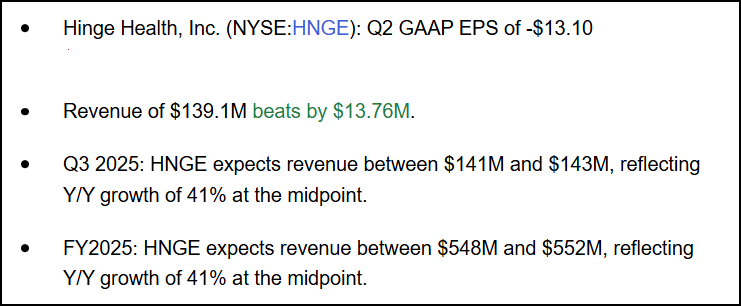

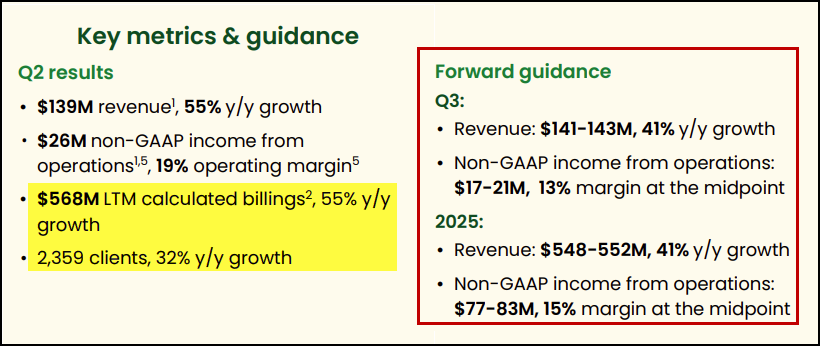

Hinge reached a seminal inflection point last night, posting a quadruple-barrelled inflection point:

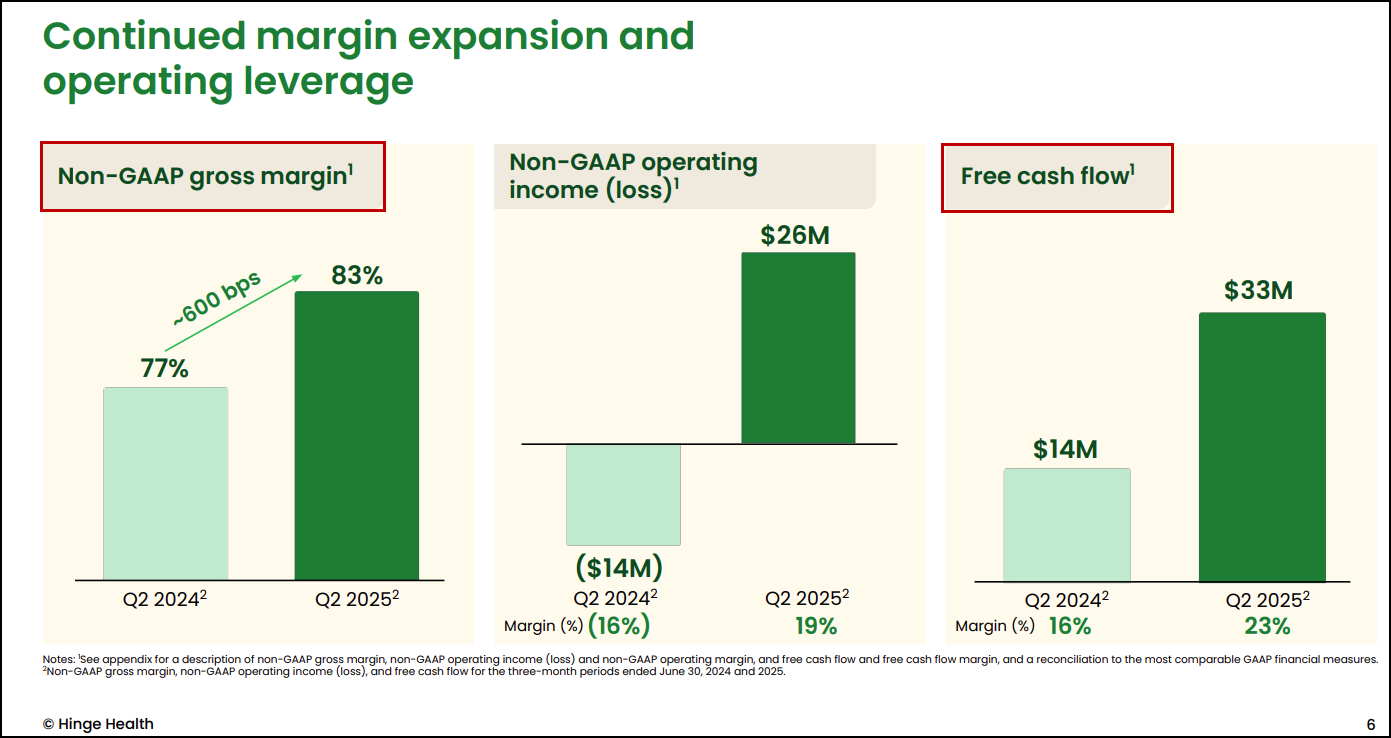

Hinge will now be a cash-flow machine going forward. Some additional metrics:

Hinge not only beat BIG but also raised their guidance substantially as well:

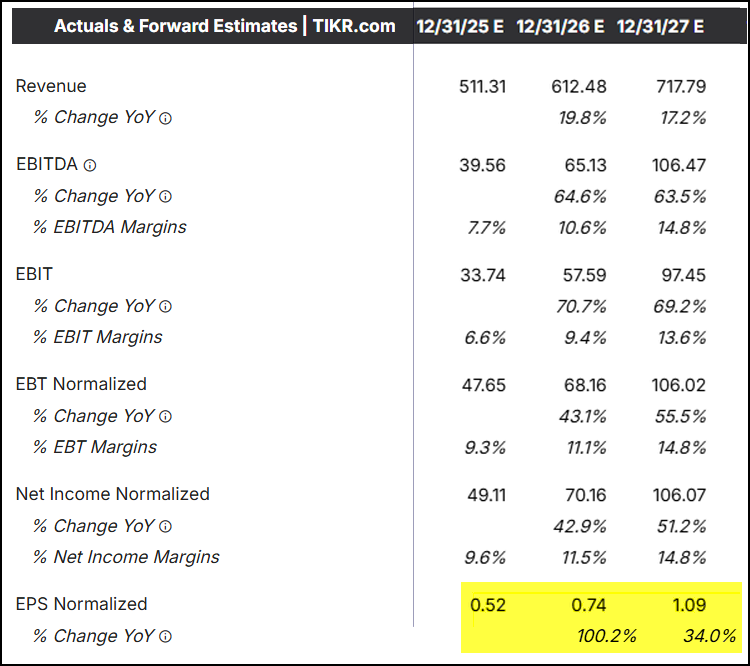

We see the big growth for Hinge continuing well into 2026, propelling it to approach $1B in revenues in 2027. Importantly, profitability should inflect to a 35% EBITDA margin by then.

The math is compelling and it’s not a stretch to model out $2.50 of fully diluted EPS, a 300% increase from 2025-2027. This compares quite favorably to current forward consensus:

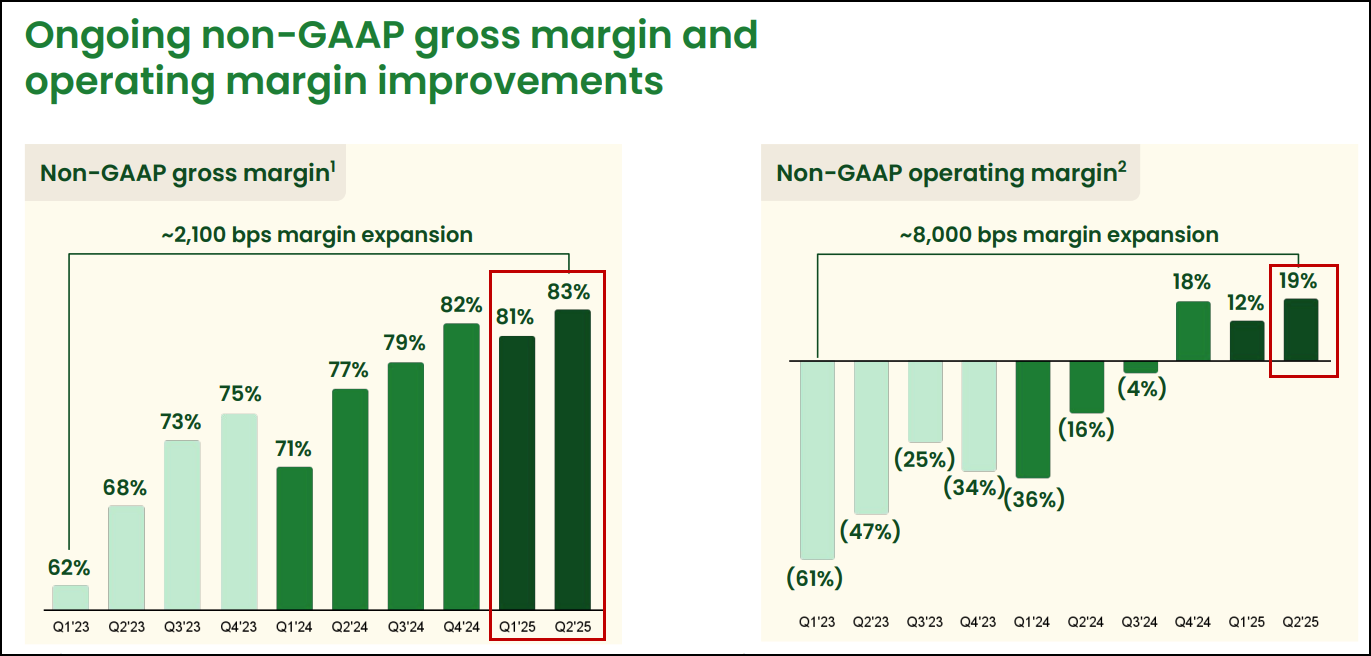

Hinge has put on a master class in how and when to bring a company public. Not just when the Top Line is accelerating to record levels with accelerating growth rates, but also when its profitability is inflecting even more powerfully. To put this Top Tier inflection in context:

Then, in Q1, Gross Margin inflected to 81%, a 10bp improvement Y/Y. Increased Gross Margin ushered in a powerful inflection in profitability. On $124M in revenues (+49.4% Y/Y), which was energized by its client-base increase to 2,300 (+26% Y/Y), Hinge saw its Operating Margin inflect to $17.1Mor ~14%.

Now, in Q2, we have Operating Margin of 19%. Incredible scale has been reached.

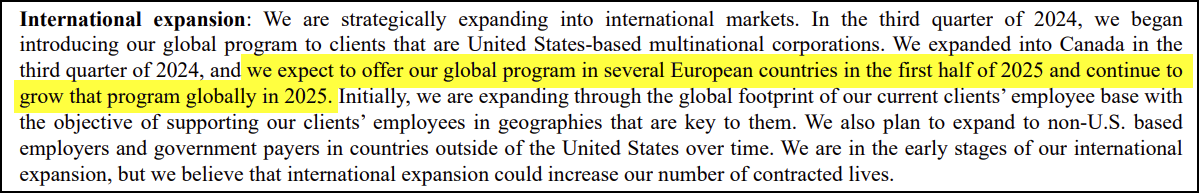

Importantly, Hinge is also adding new levers for growth, including new verticals and international expansion as well. Last quarter Hinge moved into four new countries in Europe:

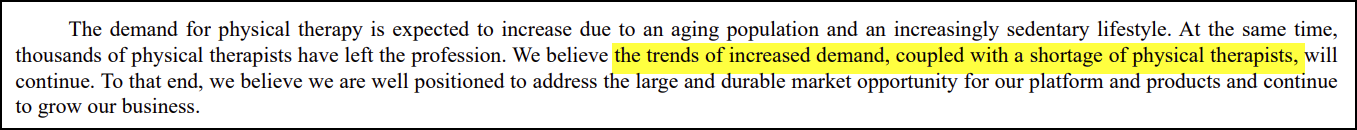

Of note, there is a shortage of PT's in the US.

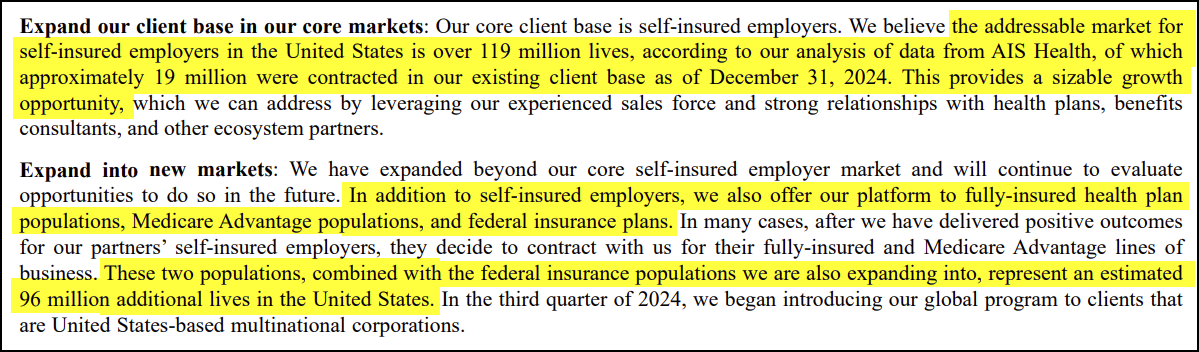

Only 16% penetrated, big runway for growth:

In the course of our due-diligence, we listened to a March 21’25, Buy-Side call presented by Expert Insights. There was some great commentary regarding Hinge from industry insiders:

“People love Hinge, they're a market leader. They’ve got a great reputation. The fact that a member of ours finds out that they have Hinge included with their health plan is typically a big delighter and is commonly a reason why they might choose to renew their plan with us when open enrollment comes around.” -- Senior Director with a large Hinge Health Payer Partner and Customer

There's still a lot of market left to obtain in the digital space, just in the space that they're in. ....To capture a bigger part of the MSK pie is to be able to also provide and capture some of the in-person care that is being done for MSK. I think that's going to be a natural progression for any digital vendor, because health plans are looking for continuity of care.”

We think HNGE is headed to $70-$75 by the time the company releases its Q3 report.

Hinge has a tiny float of only 8.5M shares. Most of it has already been sucked up. As such, we expect a quick overshoot to happen for this Top Tier Inflection.

There are about 50M early stage VC and long-term growth investors like Coatue who will look to exit once the 6 month lockup period hits.

We therefore recommend buying ANY and ALL DIPS in the stock this morning. We think it can punch to $60 and then pull back to the mid $50s, where we would be looking to add to our position.

In 3-4 quarters, we think Hinge is $100.

We can easily see how Hinge scales to be a $1.5B company in 2029, earning $5/shr, which would translate into a $200-$250 stock long-term – a move which would be discounted well ahead of time with the expected move to $100 the next four quarters.

Stop Loss: Given our conviction in Hinge’s inflection our intent is use a TIME STOP through the Q3 print. We plan to sell 3/4 of our position ahead of the lockup late this year, and hold the rest for, what we think will be, a memorable move to $100 by this time next year.

Hinge Conviction Level: 10.

---------------------------------------------------------------------------------

Disclosure: We are long HNGE stock and calls. We may change our positioning at a moment’s notice, without notifying you of any such moves.

Disclaimer: All of the information in this piece has been prepped by Inflections Consulting LLC. Readers should know that it would be incorrect to assume that past and future names of interest will be profitable or will not turn into a loss. Inflections Consulting LLC does not and will not assume any liability for any loss that could occur if you invested in such stocks written about.

All the content in these reports have been prepared by Inflections Consulting LLC. We believe our sources to be reliable, but there is no guarantee here. The information in this piece does not constitute either an offer nor a solicitation to buy or sell any of the securities name-dropped in this piece.

All contents are derived from original or published sources believed reliable, but not guaranteed. This report is for the information of Top Tier Inflections members/subscribers, only. Absolutely none of our content may be reproduced in whole or in part without prior written permission from Inflections Consulting LLC. All rights reserved.

In no shape or manner should the views expressed in this piece be considered investment advice. We reserve the right to change our positioning in our HNGE stock and options positions at a moment’s notice without updating you on any such change in opinion and positioning. That may be tomorrow, even before our price target is hit. Facts change, our opinions can change quickly too.

Investors need to consider their investment risk tolerance before investing in the stock market and also before investing in any of the stocks mentioned in this report.